In 2015, glyphosate and paraquat, representatives of sterilant herbicides, are facing the risk of being

eliminated because of the stringent environment safety regulations. Which

herbicide will become the leading product in the future sterilant herbicide

market has become a focus of discussion among industry insiders.

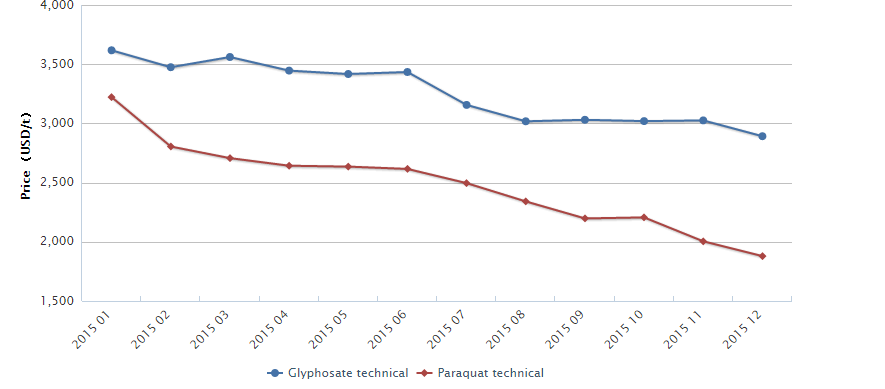

Since the resistance to glyphosate has increased and many weeds including Canadian fleabane have high resistance, the 2015 glyphosate market remained depressed with price drops. The glyphosate technical price has declined to a historical low. The mainstream transaction price has dropped to USD2,844.75/t (RMB18,500/t). Many herbicide enterprises namely Zhejiang Wynca Chemical Industry Group Co., Ltd., Nantong Jiangshan Agrochemical & Chemical Co., Ltd. and Jiangsu Yangnong Chemical Co., Ltd. recorded significant falls in both their revenue and profit from their glyphosate business. In order to reduce the resistance to glyphosate, enterprises are mixing glyphosate with other selective herbicides like dicamba.

In 2015, paraquat AS was reclassified as a highly poisonous substance, which heavily impacted the depressed paraquat market. At present, the sales of paraquat are sluggish both at home and abroad and the ex-works price of 42% paraquat TK has fallen to USD1,845.25/t (RMB12,000/t). At the same time, the development progress of non-AS paraquat is also stagnant. For instance, the registrations of 50% paraquat SG (expiry date: 8 Nov., 2015) and 20% paraquat GW (expiry date: 25 Sept., 2018) from Shandong Luba Chemical Co., Ltd. and Nanjing Redsun Co., Ltd. respectively are unlikely to be renewed. Paraquat is likely to disappear from the market in China.

From 1

July, 2016, China will ban the sale and use of paraquat AS. Although the

Ministry of Agriculture of the People’s Republic of China will still allow the

export of paraquat AS for paraquat TK manufacturers, the market share left by

paraquat AS will be filled by its competing products - glufosinate-ammonium,

diquat, glyphosate and some mixed formulations.

Glufosinate-ammonium

and diquat will become key products in the sterilant herbicide market, especially

the former. At present, many enterprises including Zhejiang Yongnong Chem. Ind.

Co., Ltd., Lier Chemical Co., Ltd. and Hebei Veyong Bio-Chemical Co., Ltd. are

investing into the glufosinate-ammonium market. The coming 5 years will be the

fast development period for glufosinate-ammonium.

However,

it will take some time for the glufosinate-ammonium market to completely open

up. High market price, extremely high production process standards, limited

output and environmental pressure are restraining the development of

glufosinate-ammonium.

Since

diquat is a similar product to paraquat, it will have good opportunities after

paraquat AS is banned. The next few years will also be the fast development

period for diquat. However, because diquat is similar to paraquat, it may

follow a similar development path to paraquat in the future. In any case,

diquat can obtain large market shares once paraquat withdraws from the market.

But how far it can go is still unknown.

CCM

believes that:

That

paraquat will withdraw from China’s sterilant herbicide market is irreversible.

The

influence of glyphosate will weaken because weeds are becoming more resistant

to glyphosate.

In the

long term, glufosinate-ammonium is very likely to become the major product in

China’s sterilant herbicide market since it is a good substitute for paraquat

and glyphosate.

Diquat

will become the major substitute for a while after paraquat AS withdraws from

the market.

To sum

up, in 2016, China's sterilant herbicide market will embrace a renewal because

of the big changes that happened in the market in 2015.

Ex-works

price of 42% paraquat TK and 95% glyphosate TC in China, 2015

Source:

CCM

About CCM:

CCM is the leading

market intelligence provider for China’s agriculture, chemicals, food &

ingredients and life science markets. Founded in 2001, CCM offers a range of

data and content solutions, from price and trade data to industry newsletters

and customized market research reports. Our clients include Monsanto, DuPont,

Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more

information about CCM, please visit www.cnchemicals.com or get in touch with us directly by

emailing econtact@cnchemicals.com or calling

+86-20-37616606.

Tag: glyphosate, paraquat, sterilant herbicides